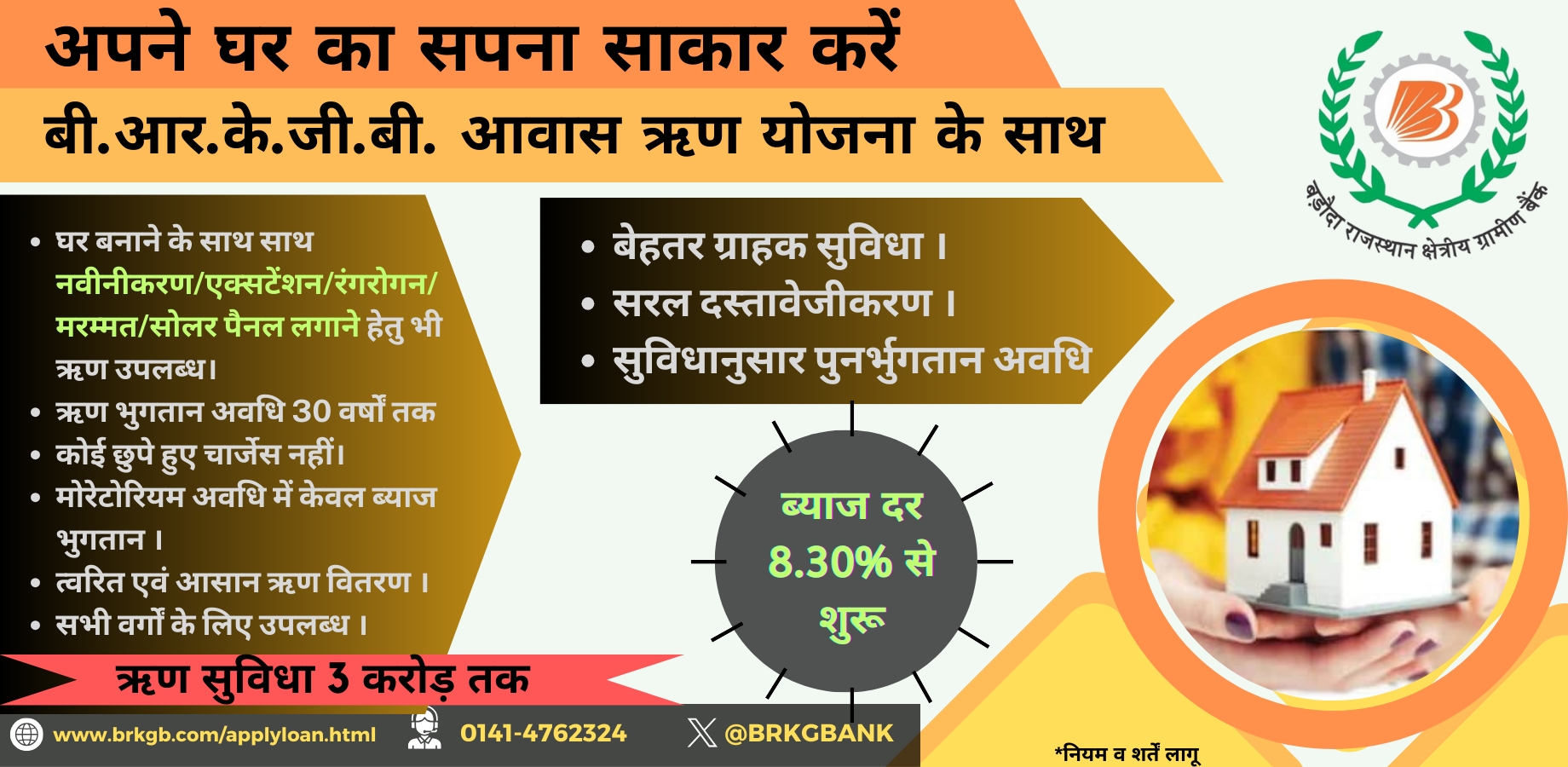

Baroda Rajasthan Kshetriya Gramin Bank

Sponsored by Bank of Baroda, was established by Central Government In exercise of the powers conferred by sub section (1) of section 23A of the Regional Rural Bank Act 1976 (21 of 1976) by issuing Gazette Notification No. F No. 719/2011-RRB dated 01-01-2013, by amalgamating 3 Regional Rural Banks viz. Baroda Rajasthan Gramin Bank, Hadoti Gramin Bank and Rajasthan Gramin Bank, Sponsored by Bank of Baroda, Central Bank of India and Punjab National Bank respectively. The Head Office of the Bank is at Ajmer and it’s 12 Regional Offices are at Alwar, Banswara, Baran, Bharatpur, Bhilwara, Chitttorgarh, Churu, Jhunjhunu, Kota, Neem Ka Thana, Sawaimadhopur and Sikar.

.jpg)

.png)

.png)

.png)